how are qualified annuities taxed

Ad Annuities are often complex retirement investment products. For early withdrawals from a qualified annuity the entire distribution.

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan

If an annuitant opens an annuity with funds that have not been previously taxed then it is considered a qualified annuity In most cases such annuities are.

. How Qualified Annuities Are Taxed. Qualified is a descriptor given by the Internal. First if your annuity was purchased with IRA or 401k monies then all withdrawals are taxed for the life of the annuity.

The answer to this question depends on the type of annuity you have. If however your annuity was. However qualified and non-qualified annuities.

So if you wrote a check from your taxable bank or brokerage account to pay the premium. It lets you defer up to 25 of RMDs until age 85 and thus reduce your taxes. Ad Learn More about How Annuities Work from Fidelity.

A qualified annuity is a financial product that accepts and grows funds and is funded with pre-tax dollars. A qualified annuity is distinguished from a non-qualified annuity which is funded by post-tax dollars. An annuity funded with pre-tax dollars is often a qualified annuity.

Learn some startling facts. If you have a qualified annuity contributions may be tax deductible up to a certain amount. Based on whether you purchased the annuity with qualified pre-tax or nonqualified post-tax.

A non-qualified annuity is you purchased with money you have already paid taxes on. This type of annuity is called qualified. It only becomes taxable once you begin receiving the funds from your annuity.

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. Ad Annuities are often complex retirement investment products. Non-qualified annuities require tax payments on only the earnings.

Owners of qualified annuities are required by law to. The amount of taxes on non-qualified annuities is determined by something called the exclusion ratio. Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Usually a 401k or another tax-deferred. When you receive money from a nonqualified variable annuity only your net gainthe earnings on your investmentis taxable. Tax on Withdrawals and Income.

Until you receive your annuity distributions or stream of income taxes are deferred. In this case the tax rules governing qualified plans and IRAs essentially trump the annuity tax rules which generally means that the full annuity payout is taxed as ordinary. Funds for a qualified annuity typically come directly from a 401k a.

Qualified employee annuities - a retirement annuity purchased by an employer for an employee under a plan that meets certain Internal Revenue Code requirements. The exclusion ratio is. An annuity that has been funded with previously untaxed funds is considered a qualified annuity.

A qualified annuity is an annuity that meets the requirements of Internal Revenue Code section 401 a and is therefore eligible for certain tax benefits. Annuity withdrawals made before you reach age 59½ are typically subject to a 10 early withdrawal penalty tax. Qualified annuity taxation.

Qualified annuities are usually funds from an IRA or a 401 k. Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals. Learn some startling facts.

A non-qualified annuity is an annuity bought with after-tax dollars whereas a qualified annuity is an annuity bought with pretax dollars in most cases. Income from an annuity is taxed as ordinary income which means that you will pay the same tax rate on your withdrawals as you would on any other type of income such as wages from a job. An immediate annuity can be purchased with pre-tax money qualified annuities or post-tax money non-qualified annuities.

Take a Closer Look at the Main Types of Annuities Common FAQs. Qualified annuities are purchased with pre-taxed income. You fund a qualified annuity with pre-tax money money you have yet to pay taxes on.

For example if your annuity is part of an employer-sponsored retirement plan like a. Ad Learn More about How Annuities Work from Fidelity. A qualified longevity annuity contract or QLAC is a qualified annuity that meets IRS requirements.

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan

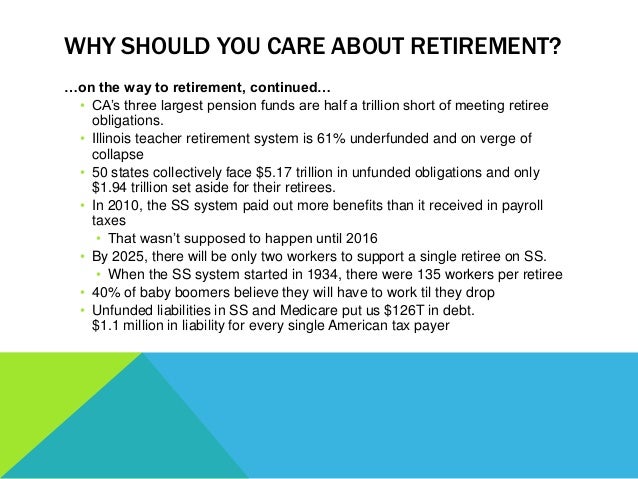

If You Currently Have Your Money Sitting In The First 2 Buckets You Are Straight Up Dropping Coins Financial Seminar Financial Counseling Financial Education

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan

Charting The Differences 401k Vs Ira Vs Roth Ira Saving Money Budget Finance Investing Budgeting Money

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan

If You Currently Have Your Money Sitting In The First 2 Buckets You Are Straight Up Dropping Coins Financial Seminar Financial Counseling Financial Education

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan

Pin On Words Of Life By My Beloved

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan

![]()

If You Currently Have Your Money Sitting In The First 2 Buckets You Are Straight Up Dropping Coins Financial Seminar Financial Counseling Financial Education

Pin By Family Benefit Solutions Llc On Retirement Planning Teacher Retirement Retirement Planning How To Plan